IELTS academic task 1 sample essay 22: income tax comparison per civil status

Home » Academic writing task 1 sample essays & answer » IELTS academic task 1 sample essay 22: income tax comparison per civil status

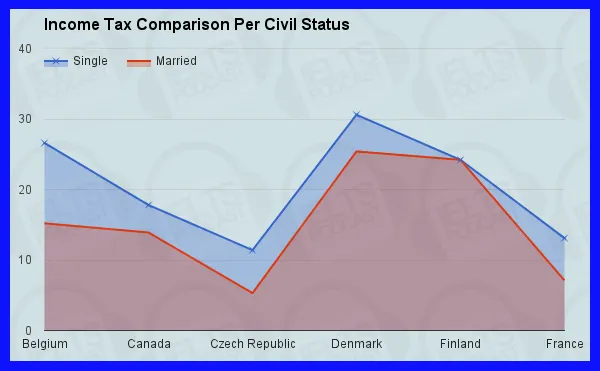

This graph compares income tax across six countries, based on civil status (married or single). The six countries shown are Belgium, Canada, the Czech Republic, Denmark, Finland, and France.

Income tax, for both civil statuses, is lowest in the Czech Republic. The lowest tax rate shown on the graph is married status tax of only about 5 percent in the Czech Republic. Married and single income tax rates are only slightly higher in France. Third lowest are tax rates in Canada.

In Belgium, taxes for married status are lower than in Finland. Belgium’s single status income tax is higher than Finland’s, however. Income tax rates for both civil statuses are highest in Denmark, where the single income tax rate reaches 30 percent.

Finland is the only country where the two tax rates are the same. In none of the six countries is married income tax higher than single income tax. The largest gap between the two rates occurs in Belgium.

(160 words)